Benefits of Membership in the Private Pension Fund "Albsig"

DOWNLOAD THE DOCUMENT

Benefits of Membership in the Private Pension Fund "Albsig"

- Benefits for the Individual

Maximum contribution limit

Periodic contributions are deductible from personal income for tax purposes, with the maximum monthly limit that can be excluded being the country’s minimum wage, currently 40,000 lek per month (approximately 480,000 lek per year).

Tax on periodic payments

Monthly pension payments are taxed only on the return on investment, at the applicable personal income tax rate, if the withdrawal is made over a period of no less than 2 years in installments.

Tax-exempt investments

Investments in the fund are exempt from tax on interest and capital gains (unlike an investment made individually where interest and capital gains are taxed);

Trashëgueshmëria

Në rast të humbjes së jetës fondi i pensionit privat është i trashëgueshëm sipas akteve ligjore në fuqi që rregullojnë trashëgiminë;

Professional management and diversification

Investments are carried out by highly specialized professionals to make the most appropriate investments for the pension fund, which positively affects the rate of return; The main advantage of private pension funds compared to individual investments is the diversification opportunity that the funds offer;

Flexibility and pension payments

The possibility of returning the accumulated investment in pension payments, earning interest again and high flexibility in the ways of withdrawing the accumulated amount for pension;

Small contributions and automation

Depositing small amounts below the required minimum deposit and bond amounts and the possibility of making payments automatically each month;

Full transparency

Members are provided with a username and password which they can use at any time to check their personal online account. This account displays all contributions made, the fund’s rate of return and other important information;

Security for the future

Creating a pension scheme in Albania is a must for everyone. Currently, the state scheme (the only one that provides a pension) replaces on average only 35% of your income in the form of a pension (you will have a pension equal to 35% of your average salary). While this replacement rate should be no less than 75%.

Shorter benefit payment periods

Payment of pension benefits is made within 15 days, compared to 30 days previously.

Transparency and detailed information

Members are provided once a year with a certificate of their personal account balance, the fund prospectus, interim and annual reports, and audited financial statements.

- Benefits for Business

HR strategy and differentiation

It is part of modern human resources policies, differentiating the business from competitors and helping to attract quality talent.

Tax benefits for the employer

Contributions made by the employer in the interest of its employees are assessed as an operating expense up to the annual amount for each employee, equal to 40,000 lek per month (approximately 480,000 lek per year), and this amount is deductible for income tax purposes.

“Vesting period”

The employer determines in the contract the minimum period of stay of the employee in the company (“vesting period”) to benefit from this investment. This period is limited by law to 5 years.

HR strategy and differentiation

It is part of modern human resources policies, differentiating the business from competitors and helping to attract quality talent.

Motivation and stability

Contributions to a private pension fund help reduce employee turnover, making them more stable in the company, and increase their motivation, commitment, and productivity, as they feel valued and secure about their financial future.

Optimization of the benefits package

Private pensions constitute a valuable addition to the benefits package for employees, complementing health insurance or traditional bonuses.

Impact on the company's reputation

A business that cares about the financial future of its employees is seen as a responsible employer, positively impacting the employer brand.

Long-term financial planning

Contributions to the pension fund become an instrument for better management of human resource costs in the long term.

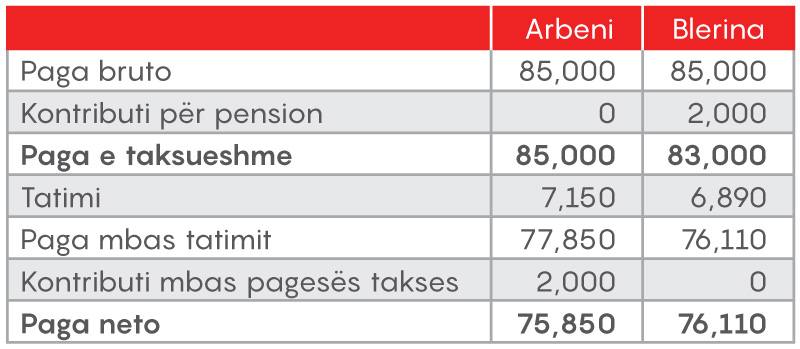

Tax benefits from deduction from gross salary

Blerina contributes to a pension fund while Arben saves his salary individually in a deposit or other investment. Below is the difference that results in net income from salary if these two methods are followed. The difference comes from the preferential treatment given by Law No. 76/2023 “On Private Pension Funds” and the Tax Law of the Republic of Albania regarding contributions to pension funds.

The benefits of saving as early as possible

Investing in pension funds is considered a non-taxable investment.

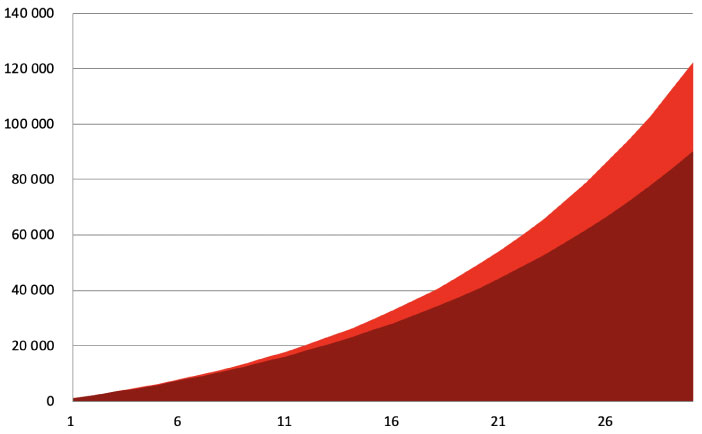

Interest income from bonds and notes in the pension fund is not taxed. Whereas if you invest individually in deposits or in bonds and notes, you will be taxed on the interest income from these assets. Considered over a long time horizon, the effect of reinvesting non-taxable interest (compound interest) increases the tax benefit of the fund’s assets, resulting in a much greater accumulation than individual investments. This is one of the main advantages that drives individuals to save in pension funds.

The difference between the amount accumulated in a pension fund that is not taxed on income (in red) and an amount accumulated that is taxed on income (in cherry) over a period of 30 years.

The difference between the amount accumulated in a pension fund that is not taxed on income (in red) and an amount accumulated that is taxed on income (in cherry) over a 30-year period.