Benefits to Individuals

Benefits to Individuals

- Contributions are tax deductible. In the voluntary pension fund law, there is a limit for this tax deductibility which is the lowest value between 200,000 lekë of contributions and 15% of the gross salary if the member is below 50 years old. If the member is above 50 years old the upper limit is the lowest value between 250,000 lekë and 25% of gross annual salary.

- Investment income is excluded from taxation( on the other hand if you do investments individually you get taxed of interest income).

- Professional management of the assets in the funds offering diversification which it cannot be done by individually trying to invest. Investments are selected by professional teams which have experience and can make better decisions that individuals that don’t have a finance profession.

- The option of receiving periodic withdrawals while the outstanding amount growth with the rate of return of the fund.

- Contributions are tax deductible. In the voluntary pension fund law, there is a limit for this tax deductibility which is the lowest value between 200,000 lekë of contributions and 15% of the gross salary if the member is below 50 years old. If the member is above 50 years old the upper limit is the lowest value between 250,000 lekë and 25% of gross annual salary.

- Investment income is excluded from taxation( on the other hand if you do investments individually you get taxed of interest income).

- Professional management of the assets in the funds offering diversification which it cannot be done by individually trying to invest. Investments are selected by professional teams which have experience and can make better decisions that individuals that don’t have a finance profession.

- The option of receiving periodic withdrawals while the outstanding amount growth with the rate of return of the fund.

Advantages to Businesses

- Opening a professional scheme for employees differentiates the business from other businesses and makes it more competitive, hiring better employees.

- Contributions made by the employer in a professional scheme are considered expenses and taxed up to an upper limit of 250,000 Lekë for each member.

- There is a vesting period in the law on voluntary pension funds. up to two years, for employees if they become part of a professional scheme.

- Decreases employee turn-over.

- Leads to more productive works.

Tax Withholding

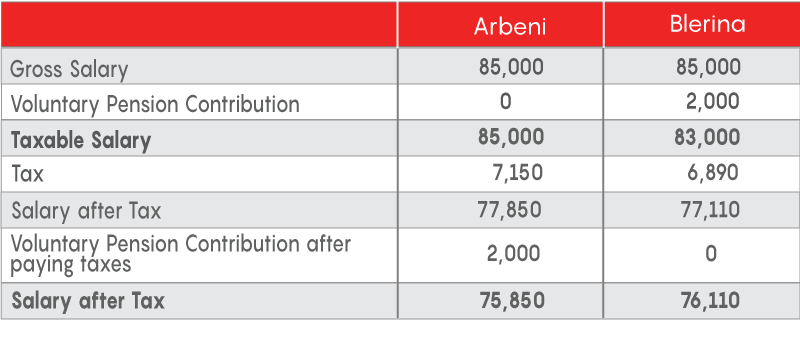

Blerina contributes to a pension fund while Arben saves from his salary individually in a bank deposit or other investment. Below is the difference in net income from salary if these two ways are followed. The difference comes from the preferential treatment of Law no. 10 197, dated 10.12.2009 “On voluntary pension funds” and the law on Taxes of the Republic of Albania given to contributions to pension funds.

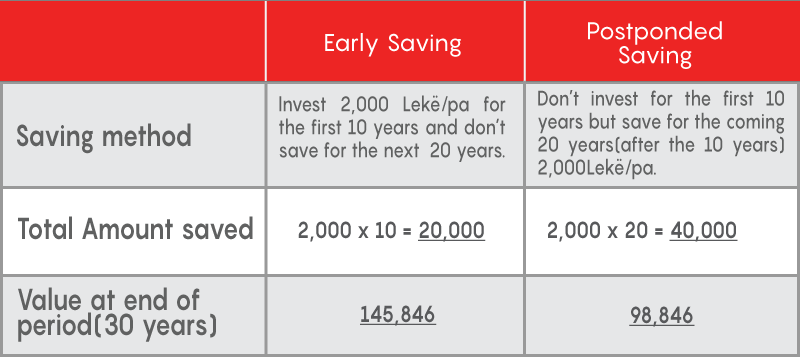

The benefits of saving early

Investment income is not taxable

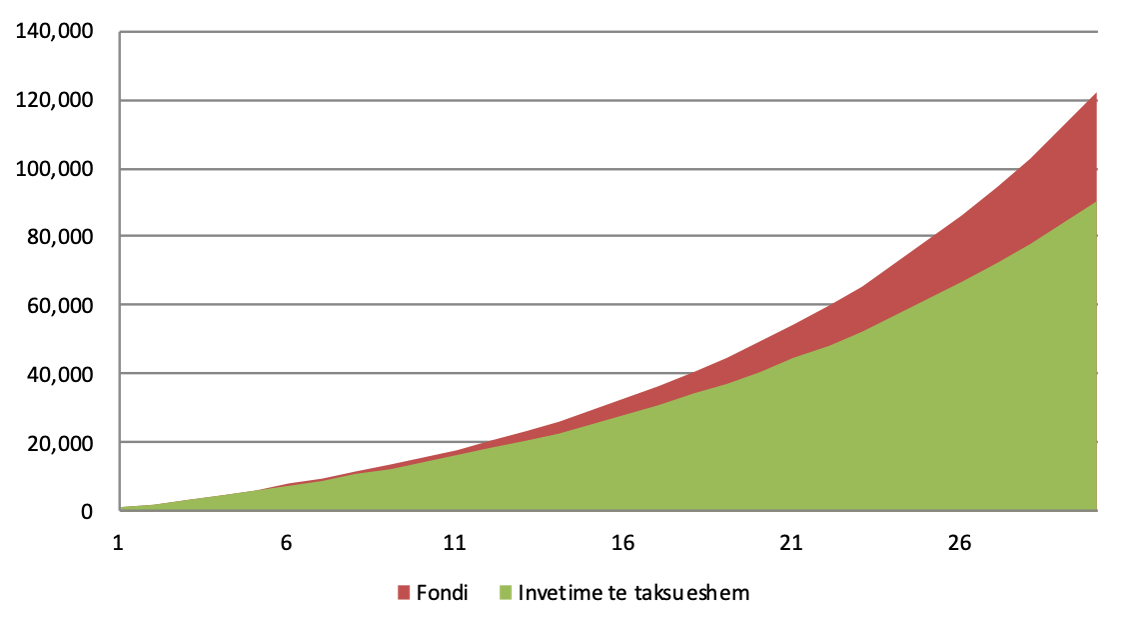

Investment income such as interest and capital gains are not taxed in the pension fund. While an investment done individually incurs interest and capital gain tax.

Considering a very long investment horizon, the compound interest enlarges the amounts in the tax deferred accounts (pension funds) compared with taxable accounts. In red is shown the deferred tax account of the pension fund and in green is shown a taxable account, while even though having the same rate of return, there result a very big difference in end value between these two accounts.

ABOUT US

CONTACT

![]() Bulevardi Bajram Curri, Albsig HQ, Tirana, Albania 1010, Kati 16

Bulevardi Bajram Curri, Albsig HQ, Tirana, Albania 1010, Kati 16

![]() Email: [email protected]

Email: [email protected]

![]() NUIS: L92208025J

NUIS: L92208025J