Investment Fund

ALBSIG STANDARD Investment Fund is a collective investment undertaking (SIK) with an open public offering, established for an indefinite period, licensed in the Republic of Albania by the Financial Supervisory Authority and established and managed by Albsig Invest sh.a.

The fund will invest mainly in bills and bonds of the Republic of Albanian and is addressed to conservative clients with a medium-term investment horizon of 2-5 years, offering high liquidity (the possibility of withdrawing amounts at any time).

The main elements of the investment policy are:

- Objective: The fund aims to maximize profits while maintaining principal and liquidity;

- Risk tolerance: Low;

- Investment Horizon: Medium Term (2-5 years).

Characteristics and Advantages of the Fund

- Investment diversification opportunities: Investment funds provide individuals with the opportunity to diversify by investing in certain securities, which individuals cannot carry out on their own;

- Annual administration commission: 1% – The administration cost fee is deducted from the gross income realized from the fund assets;

- Low risk profile: Investment in bonds and bonds of the Republic of Albania is considered as the investment with the lowest risk than other assets in the capital market in Albania;

- High Liquidity: The investor may withdraw at any time without compromising the interest earned up to that point;

- Inherited and transferable;

- High Transparency: Investors are given a username and password which they can use to access their “online” account which presents performance and other data related to the Fund;

- The possibility of investing in small amounts (compared to government billss and bonds or deposits) which are added to the initial investment;

- Professional Investment Management: Investments are carried out by a staff certified by the CFA Institute, world-renowned for the highest standards of professionalism and ethics in investment management;

- The fund is not a deposit and as such is not secured by (ASD).

The fund does not guarantee a predefined rate of return. The rate of return is dependenton the interest rates of Albanian Government Bonds which fluctuate, affecting the the value of the investment.

Purchase of Units

To invest (buy units) in the ALBSIG STANDARD Investment Fund you can apply at the offices of Albsig Invest, Rr. Barrikadave, Albsig HQ, Floor 8, Tirana, in the branches of Albsig Sha, or with agents who have entered into a contract for the sale of units (their address is located on the website of the Management Company at the section Investment Funds / Agents Authorized for Sale). Obtain the information / documentation of the Fund and complete a request for the purchase of units. The purchase of units will be considred finalized only after the payment of funds.

Unit Purchase Application can be completed as:

- Immediate payment which means investing a single amount;

- Investment plan, which means periodic investment through regular ongoing payments.

Any payment for the purchase of units is made at a bank account with IBAN: AL49 2061 1004 0000 1003 2129 9100, opened at the Depository Bank, which is Banka Tirana Sh .a. in one of the following ways:

- Cash payment directly to the account at the Depository Bank;

- Transfer from the investor’s account (at any other second-tier bank) to the Fund’s account.

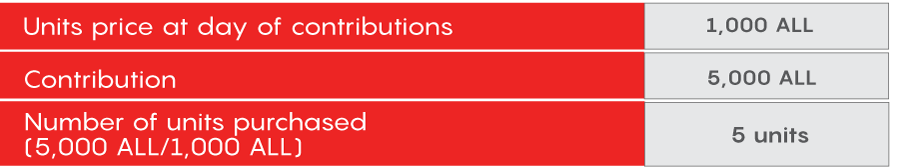

Example Buying Units

The unit price in an investment fund is calculated daily. Any purchase or repayment of units in the Fund will be made in Lek. The investor’s account value is calculated by multiplying by the number of his units at the unit price.

Unit Sale

Investors or unit holders have the right to request the repayment of their units at any time. An investor going to Albsig branches or agents who have entered into a contract for the sale service (their address is on the website of the Management Company in the section Investment Funds / Authorized Agents for Sale) must sign a request for unit sale. In this request for sale or repayment of units, the investor must also put the account number of a second tier bank as the monetary assets will pass from the Fund’s account at the Depository Bank towards the investor’s account. The Management Company must comply with the request of investors for the repayment of units not longer than 7 (seven) calendar days from the date of registration of the request for withdrawal. The applicable price for withdrawal is that of the date of registration of the claim.

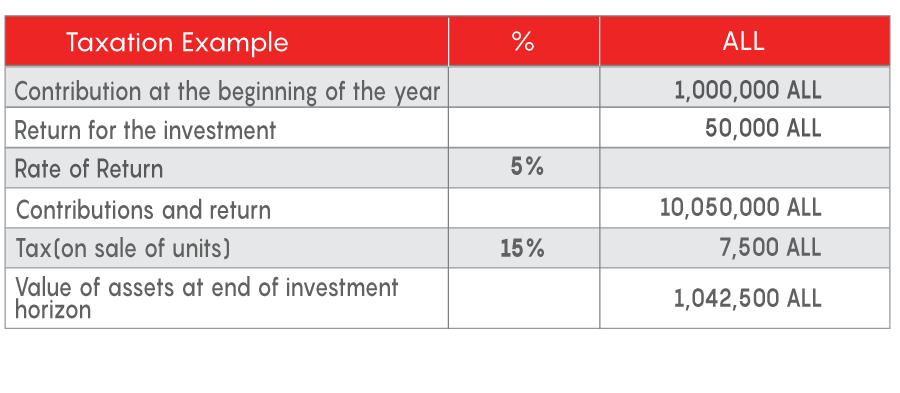

Taxation

By the sale of units, the investor must be subject to income tax. Taxation of the Fund is based on Law no. 8438, dated 28.12.1998 “On income tax” amended, as well as the by laws issued in its implementation. The investor is taxed only for the value added to the contributions.

ABOUT US

CONTACT

![]() Bulevardi Bajram Curri, Albsig HQ, Tirana, Albania 1010, Kati 16

Bulevardi Bajram Curri, Albsig HQ, Tirana, Albania 1010, Kati 16

![]() Email: [email protected]

Email: [email protected]

![]() NUIS: L92208025J

NUIS: L92208025J